How I make $10k per month after only 3 months freelancing

It's rare that freelancers talk openly about money preferring to keep our experiences to ourselves. I'm different. Here's how I grew my business to earn $10k per month within my first few months freelancing.

Dan Spratling

December 9, 2020

12 min read

In the 3 months I've been working as a freelancer I've gone from working 1 week in a month to earning double the salary I made at my last job, and I wouldn't have been able to do that without understanding my value and taking the risk required to create a business on my own.

Disclaimer: My earnings and expenses WILL be different from yours, and many things can factor into these figures including experience, location, industry, and project type. Trends are far more important to understand than figures, so focus on that more than the actual monetary value. Figures are converted to USD for easiest comparisons, but note that I am based in the UK.

How did I get here?

I started freelancing in July 2020. We were in the middle of a lockdown at the time, due to the Covid pandemic, and I was on the verge of being made redundant from my current firm. I'd been considering freelancing for a while, so I'd been doing my research and figuring out the best way to approach the change, which I've written about here.

Breaking down my financials

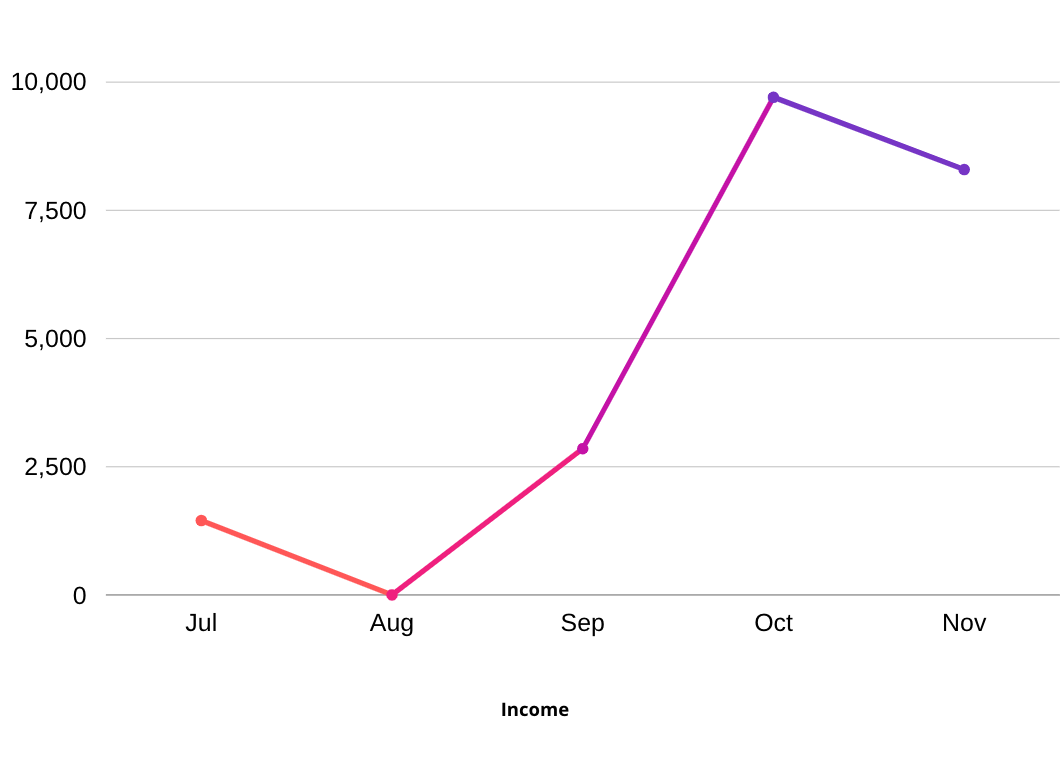

Income

So far I've worked for 2 clients. One as a once-off project and one which is a continuing long-term relationship. For my first 2 months, I only worked for a single week, but for the third month I worked most days which you can see in the graph below.

| Month | Income |

|---|---|

| July | $1,451.00 |

| August | $0 |

| September | $2,852.00 |

| October | $9,705.00 |

| November | $8,296.00 |

| --- | --- |

| Totals | $22,304.00 |

While these numbers look great, keep in mind that we're only looking at the good part. We still need to consider all of the expenses which come with running a business, even one conducted entirely online.

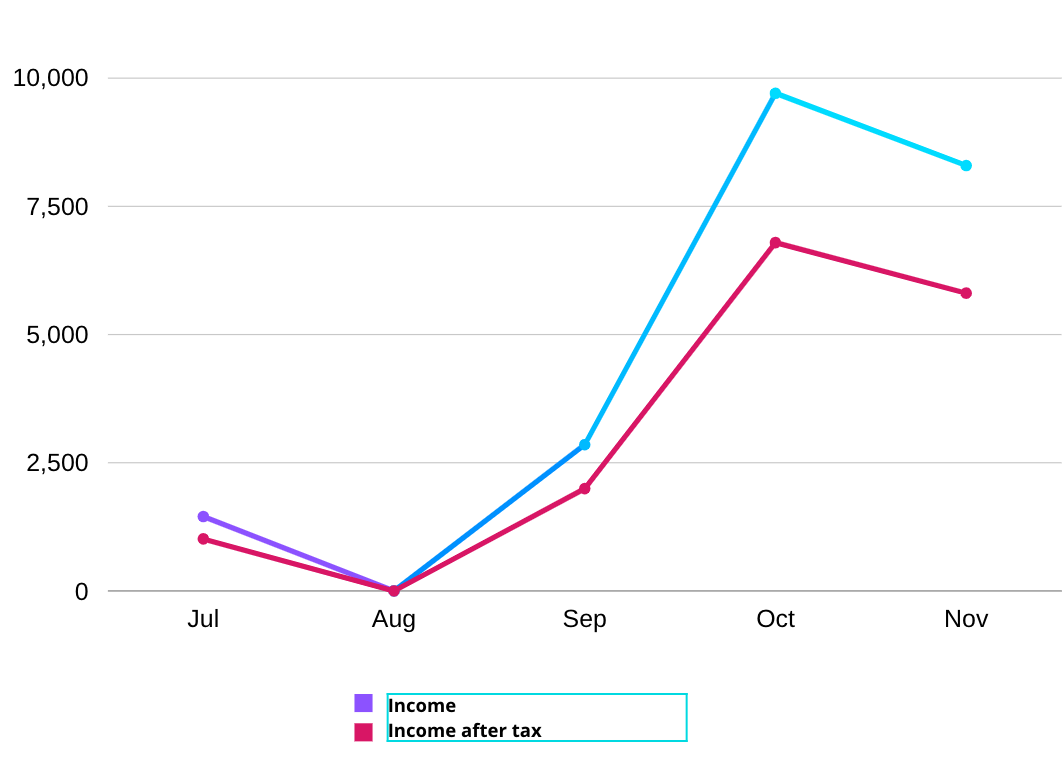

Tax & Insurance

As with all businesses, I am charged tax on my income. This means that I do not get to keep everything I earn. A good estimate is to keep 30% of your income aside to pay for tax and other government expenses. I like to be cautious so I actually save slightly more than that, as I will not know the amount to pay until the end of the tax year.

| Month | Income | Tax (est 30%) | Income after tax |

|---|---|---|---|

| July | $1,451.00 | $435.30 | $1,015.70 |

| August | $0 | $0 | $0 |

| September | $2,852.00 | $855.60 | $1,996.40 |

| October | $9,705.00 | $2,911.50 | $6,793.50 |

| November | $8,296.00 | $2,488.80 | $5,807.20 |

| --- | --- | --- | --- |

| Totals | $22,304.00 | $6,691.20 | $15,612.80 |

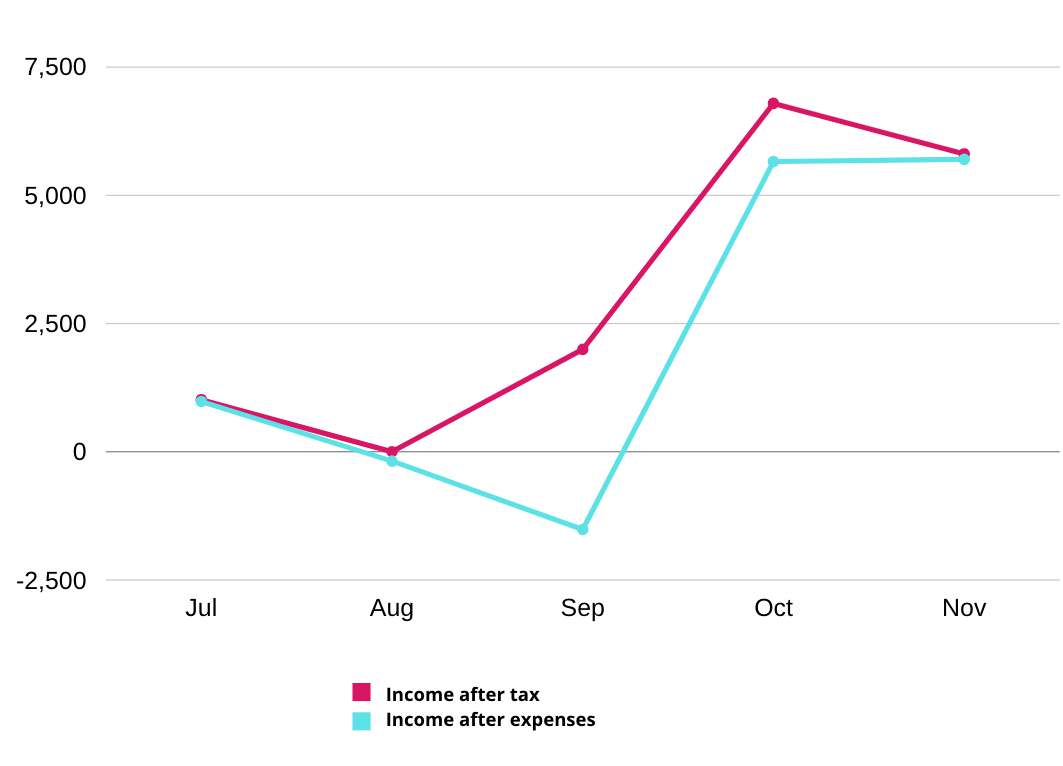

Business Expenses

Of course, no business is without expenses. Especially one starting from nothing. Most of the expenses incurred were "optional", by which I mean I did not need to purchase them immediately and as you can see, I waited until I had work (and therefore, income) lined up before buying the larger purchases. I could have delayed these purchases until I had more income if required, at the expense of some performance or ergonomics.

- July - Largest expense: Learning materials at $24

- August - Largest expense: Software Licenses at $131

- September - Largest expense: New laptop at $3315

- October - Largest expense: New desk/chair setup at $530 each

- November - Largest expense: Learning materials at $53

(All expenses have tax included in their price)

| Month | Income | Tax (est 30%) | Income after tax | Expenses | Income after expenses |

|---|---|---|---|---|---|

| July | $1,451.00 | $435.30 | $1,015.70 | $35.00 | $980.70 |

| August | $0 | 0 | 0 | $183.00 | -$183.00 |

| September | $2,852.00 | $855.60 | $1,996.40 | $3,513.00 | -$1,516.60 |

| October | $9,705.00 | $2,911.50 | $6,793.50 | $1,133.00 | $5,660.50 |

| November | $8,296.00 | $2,488.80 | $5,807.20 | $106.00 | $5,701.20 |

| --- | --- | --- | --- | --- | --- |

| Totals | $22,304.00 | $6,691.20 | $15,612.80 | $4,970.00 | $10,642.80 |

Of course, business expenses are not the only expenses to worry about when working for yourself. You also need to consider personal expenses - you need to buy food and pay rent after all. Just covering your business expenses isn't enough. Ensure you are earning enough to cover both your business and personal expenses.

On average, my personal expenses are around $1600 (£1200) per month so it's essential I earn more than this. Personal expenses are always something to consider when calculating how much your freelance business needs to earn, as you still need to earn enough to pay your bills and effectively pay yourself a wage. Below is a new graph, taking personal expenses into account.

| Month | Income | Tax (est 30%) | Income after tax | Expenses | Income after expenses | Income after personal Expenses |

|---|---|---|---|---|---|---|

| July | $1,451.00 | $435.30 | $1,015.70 | $35.00 | $980.70 | -$619.30 |

| August | $0 | $0 | $0 | $183.00 | -$183.00 | -$1,783.00 |

| September | $2,852.00 | $855.60 | $1,996.40 | $3,513.00 | -$1,516.60 | -$3,116.60 |

| October | $9,705.00 | $2,911.50 | $6,793.50 | $1,133.00 | $5,660.50 | $4,060.50 |

| November | $8,296.00 | $2,488.80 | $5,807.20 | $106.00 | $5,701.20 | $4,101.20 |

| --- | --- | --- | --- | --- | --- | --- |

| Totals | $22,304.00 | $6,691.20 | $15,612.80 | $4,970.00 | $10,642.80 | $2,642.80 |

Summary

These graphs may look like they are getting worse and worse, and over the course of 5 months I've not made a lot of money considering how flashy "earning $10k in a month" sounds. I earned very little for the first 3 months due to the time and effort required just finding the work. These are only the first few months of freelancing, and this is why starting any business is hard, and it's always possible for there to be more periods where I don't have much work.

I needed to improve my setup and order some new equipment (an ergonomic chair, desk and a new laptop) which were a significant cost but could also have been delayed if necessary, and did not have to be as expensive as the ones I chose. I could have opted for cheaper equipment or delayed the purchases if I was worried about the expenses. These are expenses which won't occur for another 3-5 years however, so this upfront cost doesn't concern me.

With the major expenses now paid for, all further income can be used for future business growth and ensuring stability.

Tags:

Career

Finance

Freelance